Auctions vs. Lender Marketplace: The Better Platform for Selling Your Loans

In the challenging world of selling distressed commercial real estate (CRE) loans, two contenders emerge: traditional online auctions and specialized loan sale marketplaces. On the surface, they may seem quite alike, but delve deeper, and you will find compelling differences that can significantly impact your loan sale experience and profits. Unraveling these distinctions is essential in making informed decisions and maximizing the value from non-performing CRE loans.

Online Auctions: The Long-Standing Tradition

Online auctions have been a go-to for loan sales for a considerable time. These platforms involve a time-bound bidding process, often starting at 30-40% of the reserve or strike price, the lowest price a seller will accept. The auction's rapid-fire nature can create an intense environment that may lead to inflated bid prices.

Despite its popularity, the auction system carries notable downsides.

The auction format's lack of transparency can lead buyers to question the source of a bid – a competitor or the seller themselves, a practice known as shill bidding. Furthermore, the winning bidder might only offer slightly above the reserve price, and if the vetting process isn't comprehensive, there's a 50% chance the deal won't close.

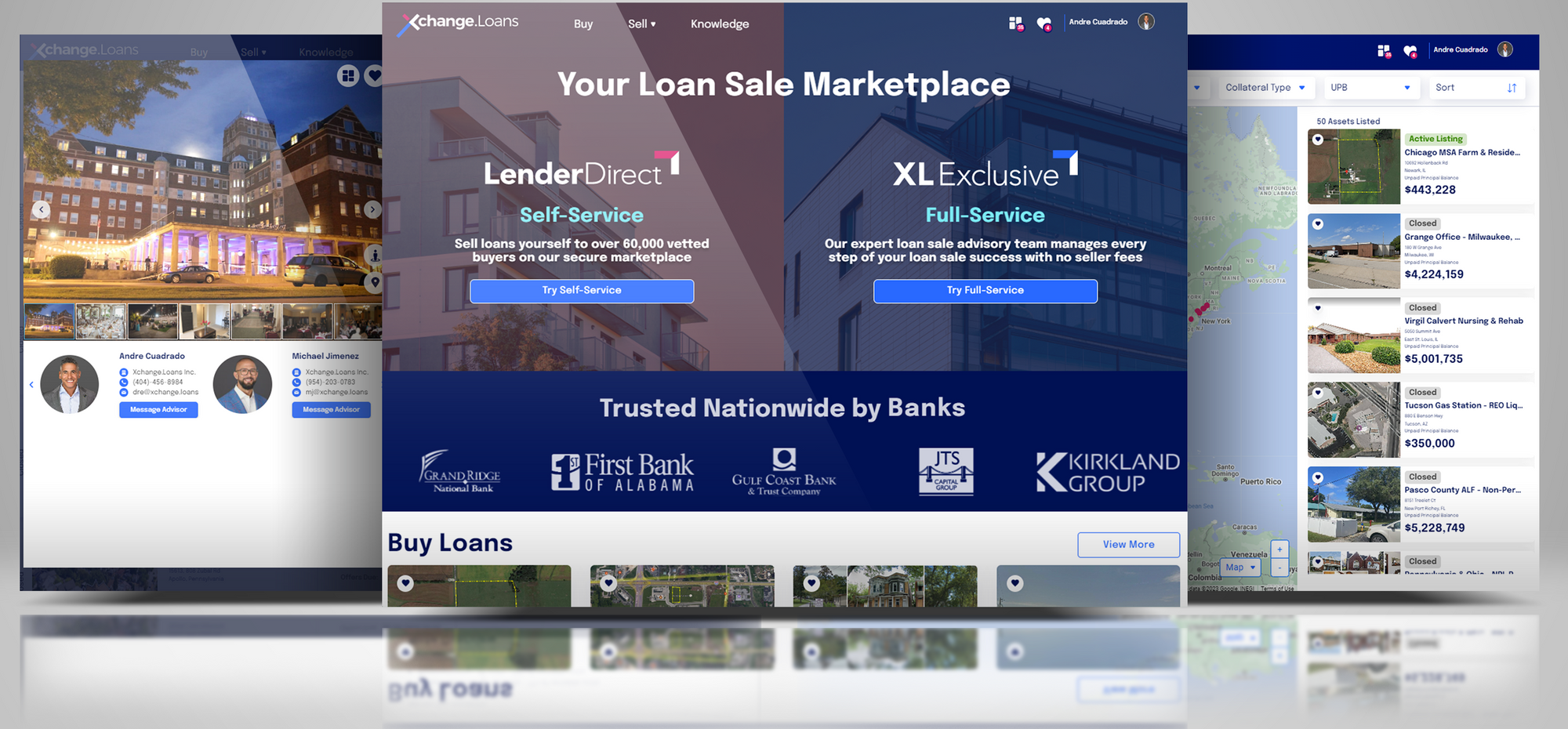

The Loan Sale Marketplace: The Modern-Day Alternative

Specialized loan sale marketplaces represent a modern solution designed to overcome the inefficiencies and uncertainties of traditional auctions. Rather than the rigid, sequential bidding of auctions, these platforms use a staged offer process encouraging a diverse array of buyers, leading to wider price discovery and optimal execution.

In a loan sale marketplace, the initial round attracts various offers, with only the most qualified buyers invited back for a final, sealed-offer round. This structure not only maximizes pricing and participation but also allows sellers to accept any offer at any time, avoiding the high-pressure environment often associated with auctions.

Moreover, these marketplaces prioritize transparency and risk mitigation for lenders. Sellers can sidestep potential issues like a failed sale or an unintentional leak of the reserve price or the discounted payoff expectation (DPO), which could create legal complications and additional risks.

Weighing the Options: Making an Informed Choice

While online auctions and loan sale marketplaces carry their unique attributes, their common goal is to serve the needs of lenders. The crucial determinant when choosing between the two platforms boils down to your specific needs and risk tolerance.

Online auctions can provide a rapid and competitive setting, yet they may lead to subpar pricing and carry potential risks due to their lack of transparency and rigorous buyer vetting.

Conversely, loan sale marketplaces offer a comprehensive solution for selling loans, particularly distressed CRE loans and NPLs. Buyers have access to extensive due diligence materials on these platforms, and sellers enjoy the flexibility to accept any offer, ensuring the best value recovery.

Conclusion: Picking the Right Platform for Your Loans

Selling distressed loans is a critical aspect of CRE lending. By understanding the differences between an online auction and a loan sale marketplace, you can make the best decision for your circumstance.Remember, selling your distressed loans does not have to be a complex process. With the right platform and strategy, you can recover substantial value from your non-performing loans.

Ready to Discover Your Loan's Value?

Explore our free loan valuation report and get a detailed estimate of your loan's potential selling price in a loan sale marketplace.