Who's Going to Buy Your Loan? Core Buyer Profiles for Loan Sales

Faced with a non-performing commercial real estate loan (CRE NPL) to sell, you might start by calling those three or four familiar note buyers and assume you’ve done your job when the deal closes. But have you? Frankly, this approach leaves money on the table—because a different buyer, with the right motivation, might have been willing to pay much more.

A much sounder approach is to have a process in place that allows for matching your particular loan and the asset that secures it with the appropriate buyer profile. It’s important to consider what types of buyers might be interested in your loan and would enable you to maximize its recoverable value.

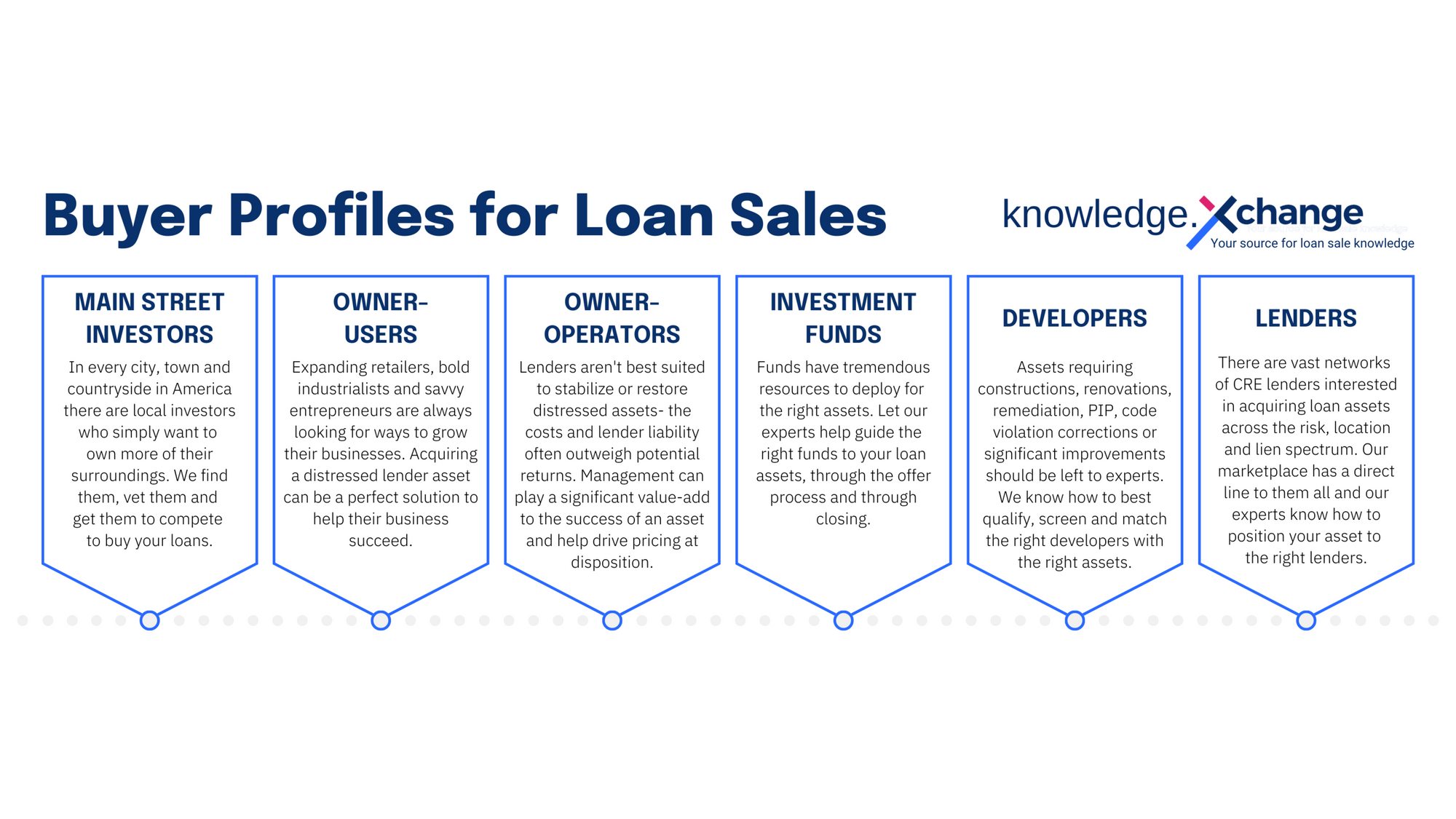

Having been in the CRE loan sales business for more than a few years, our Xchange.Loans team has identified six core buyer profiles. These buyer profiles can be categorized under the two primary asset strategies of stabilization and recapitalization.

For instance, if you are selling an NPL secured by a stabilized CRE asset that needs to be recapitalized and you’re hoping to get out at par, you’ll need to increase your exposure to funds, lenders and individual investors. If you’re selling an NPL secured by an asset housing a struggling going concern or in need of major renovations or redevelopment, you’re going to need a more hands-on owner-user, owner-operator, or developer who will understand how to manage the business or restore the asset to stability. In both cases, the best way to achieve optimal pricing is to take your note to a global online marketplace like Xchange.Loans.

Hands-on buyers bring local connections and specialized knowledge

In the case of a CRE NPL involving a going concern or a developable site, the buyer’s ability to develop, operate or manage a property matters. A deteriorating business or vacant site means a loss of economic value for a community, and the effects are compounded over time. Often, local market relationships are paramount, and someone with an understanding of complex local politics will lend invaluable perspective.

Let’s say a lender sells an NPL secured by a farm to a client that develops industrial properties. While the sale may appear to be uncontroversial, from a bank committee perspective, it’s possible that if the lender had exposed the note to a larger market, another farmer would have bought the loan for considerably more. Selling the note to another farmer would provide the added benefit of ultimately transferring the property to someone who already knows how to operate a farm. Without exposing the deal to a much broader marketplace, this perfect buyer could easily be overlooked.

Investors help limit losses

If you’re a lender looking to recapitalize a stabilized asset, you’re going to want to focus on the capital stack—that is, investment funds, other lenders, or Main Street investors. Given their small footprints and limited geographic reach, community banks in particular need to look beyond the usual suspects. Widening exposure to the full spectrum of investors helps limit losses and increase the possibility of getting out at par, and not just settling for eighty cents on the dollar or less.

Loan sale success story: Assisted living facility, Michigan

Built as a hotel in the 1920’s, a landmark hotel in Michigan, was a glamorous destination visited by everyone from Theodore Roosevelt and Jane Addams to Al Capone. It became a four-star assisted living facility in 1969. The property’s stunning waterfront views made it a desirable location for its surrounding upscale community, and as a result, it enjoyed full occupancy (by appraisal standards) for most of its operational history.

Then the COVID-19 pandemic began. A moratorium on new tenants in assisted living facilities led to a decline in occupancy to around 45%, and the resulting loss of cash flow contributed to a notice of default in late 2020. With the Bank lender facing an M & A, cleaning up its balance sheet was a priority, as a significant NPL would negatively affect the bank’s value. Xchange.Loans brought the NPL to market and arranged its purchase by a regional owner-operator committed to respecting the property’s history and restoring it to financial stability.

Xchange.Loans expands your Rolodex

When a loan is marketed publicly, it is exposed to a wide range of potential buyers with vastly different motivations for purchasing the loan, and the pricing can vary greatly. Matching the specific opportunity to the “highest and best use” buyer is the goal of Xchange.Loans, and that means understanding buyer motivations. In one of our loan sales, a Paris-based buyer paid 125% to par simply because he wanted to experience buying a note in the United States, and he owned other investment property near the lender’s asset. With 26 other bids on the table, his offer ensured that he won the deal.

Are you ready to expose your NPL to all six buyer profiles and the broadest range of bidders? It’s a wise move since more bidders equals higher pricing and certainty of execution. In our experience, the highest-bidding buyer will be found outside of your “core” rolodex 80% of the time.

Xchange.Loans creates the marketplace for you—a marketplace with a global reach that helps you find in the unexpected buyer who would not otherwise be exposed to the opportunity.

Also important, you can use our full-service option, or control the process yourself through our Lender Direct subscription toolset, with no success fees and no commission.