The Social Impact of Distressed Commercial Real Estate Loans

Ugly wire fences. Boarded-up windows. “Do Not Enter” signs. These are not the hallmarks of a thriving community—but they happen frequently when a commercial real estate (CRE) loan is in distress. You might think that a distressed CRE loan is primarily a financial problem for the lender—but it’s a community issue, too.

Look past the numbers and you’ll see the real damage that a distressed CRE loan can do to a community if not resolved quickly, and the opportunity that selling that loan could represent. Selling a distressed loan means a return to economically viable use, and a future use for a property or site that was once impaired, particularly when a workout is not a viable solution.

How distressed CRE debt can depress an entire community

Distressed debt can be an albatross that keeps an intersection, a submarket or an entire community from living up to its economic potential. A grocery-anchored shopping center, for instance, is often a vital economic engine that brings jobs, places to shop and dine, and tax revenue to the local community.

If the owner becomes unable to meet the terms of their promissory note, there’s always a risk that they will abandon their basic ownership responsibilities, such as routine property maintenance and tax payments. They may allow the retail center to go vacant, transformed into a depressing eyesore while the lender undertakes the lengthy foreclosure process.

From there, problems tend to multiply. A vacant commercial property can depress property values across a community, attract crime and contribute to general community decline. The loss of tax revenue may also create a burden on local governments. Perhaps most important, the local community loses control over its destiny when a property is tied up in foreclosure.

The difference a loan sale can make

Conversely, a loan that is sold enables an investor to either create a financing solution for the property owner or to assume ownership and restore the property to productive use. Either route provides a path back to community benefit.

Consider the fate of a CRE loan secured by a 110-room, limited-service hotel in the downtown area of a northeast Texas community. The loan was considered “sub-performing” on paper, as the borrower was still making payments—but the reality on the street was a different story. The hotel lost its brand flag and its condition deteriorated. It became a magnet for crime, while inhibiting planned redevelopment and economic revitalization.

Ultimately, we helped the lender sell the loan to a buyer with a strong personal interest in the community, who paid close to the entire unpaid principal balance. Eventually, the loan buyer took title to the property and razed the site to open it up to new development—something a lender would be reluctant to do. Selling the loan empowered a loan buyer to solve a big problem for both the lender and the community, and create a positive social and economic impact.

How lenders can prepare for distressed CRE assets

As the pandemic began to take its toll on CRE occupancy in 2020, many industry experts predicted a massive increase in distressed CRE assets. That wave has yet to occur, and no one knows exactly where, whether or when the potential land mines may appear.

Typically, the effects of larger macroeconomic disruption don’t impact capital markets and CRE properties until 6 to 18 months later. In the unique circumstances of the pandemic, however, some assets, businesses and investors were insulated by federal Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL) federal relief funds, moratoriums and relaxed regulations in a time of crisis. The question is, will that cushion last long enough for these properties and enterprises to fully recover? No one knows.

Whether or not you’re anticipating an increase in non-performing CRE loans, having a few on your balance sheet has always been part and parcel of the business of lending. The best way to benefit your balance sheet and the communities you serve is to recapitalize those distressed assets as efficiently as possible. Often, that means selling the loan—and you have better options than you might realize.

A platform with a social purpose

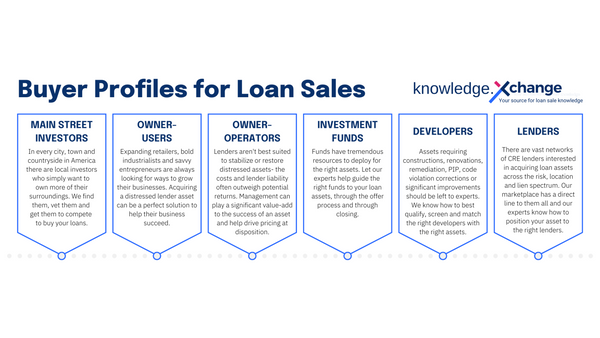

Xchange.Loans was founded on the belief that selling loans, especially non-performing loans (NPLs), can provide an immediate impact to your balance sheet, your lending organization and, most important, to the communities you serve. That’s why we created our platform: to help lenders accelerate the loan sales process and maximize the recoverable value of their NPLs, so they can continue to lend and lead with strength, confidence and liquidity.

Successful lending is the backbone of your banking business and the lifeblood of our economy. In turn, real estate is a cornerstone of the U.S. economy and helps to drive the prosperity of our homes, businesses and communities. CRE loans comprise a massive pillar of our capital markets, but are traditionally illiquid. No one benefits from an illiquid, non-performing CRE loan. In fact, all parties suffer. Increasing liquidity makes the wheels of the economy go ‘round—which is why lenders need a better way to sell their distressed loans.

Recapitalizing assets, opportunities and communities is our purpose. Communities have the right to self-determination, economic freedom and vitality, and lenders that can sell their notes with certainty, security and efficiency—without excessive fees—will be best equipped to fulfill their role within their communities.

Want to know the cash value of your CRE NPL? Try XL Value to generate a free loan valuation report.